Underwater Ballroom as Metaphor

Scripophily is the study and collection of stock and bond certificates.

Is the Underwater Ballroom of 19th century swindler, James Whitaker Wright, like the Bahamas Headquarters of Sam Bankman Fried? Are extravagant edifices the hallmark of speculators’ pipedreams?

Underwater Ballroom

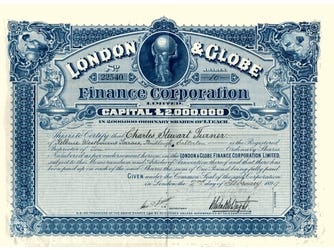

The Underwater Ballroom built by James Whitaker Wright in the Haslemere and Hindhead area of England was part of a 9,000-acre estate named Whitley Park funded by Wright’s speculative ventures.1 Wright set up the London and Globe Company in 1894. To maintain the illusion that it was making money, Wright falsified London and Globe's balance sheet, exaggerating the value of the mines that it owned and omitting liabilities. To enable it to keep paying dividends he also began to "juggle" cash between London and Globe and his other firms.2 Wright committed suicide by taking a cyanide pill upon his conviction of swindling investors of over £846m (in today’s money) in 1904.3

Scripophily

Scripophily4 is the collecting of security certificates as works of art.5 Wright’s certificates, like Enron’s are valuable only as works of art. For many, the bond and stock certificates' allure is the intersection of finance, history and art. Many of the companies whose certificates are collected are famous for their spectacular failures. The certificates offer ornate artwork celebrating some aspect of a business. 6

The International Bond & Share Society (IBSS) —collectors of Scripophily— estimates there are 30,000 collectors. An excellent guide for both the beginner and experienced collector is The Scripophily Guide by Howard Shakespeare which is a publication of International Bond and Share Society and can be downloaded from the IBSS website.

The Museum of American Finance includes a large collection of Scripophily.7

Today, the FTX Token (now defunct)

This calls to mind NFT Tokens and Sam Bankman Fried at FTX.8 Here is information about the FTX Token (FTT) created by Sam Bankman Fried.9

FTX Token (FTT) is a utility token that provides access to the FTX trading platform’s features and services. It is also the native token of the FTX ecosystem. It creates utility in the FTX ecosystem by incentivizing users to hold and use the token. FTX claims that it differs from other exchange utility tokens because it offers unique features. For example, clawback prevention is something that is very important to FTX and is not found on other exchanges. Clawbacks are when an investor loses money due to liquidation. FTX prevents this from happening by using a three-tiered liquidation model.

Will the TFF Token become a new subset of Scripophily? We do know that Sam Bankman Fried planned a big headquarters reminding us of that Underwater Ballroom.

Witley Park’s Underwater Ballroom. Amusing Planet.

Scripophily FAQs, Collectible stock bond information, Antique Stock Bond FAQs (glabarre.com); Evaluating Old Stock Certificates - Enoch Pratt Free Library (prattlibrary.org)

Bertrand, Marsha. “Paper with a Past.” Barron’s (Chicopee, Mass.) 73, no. 50 (1993): 17; Bertrand, Marsha. “Dead Stocks Spring Back to Life - As Collectibles.” Medical Economics 71, no. 8 (1994): 112.

Rozens, Aleksandrs. “Paper Gains: Would You Pay $300 for an Enron Bond? These Folks Will.” The Investment Dealers’ Digest : IDD, 2008.

The Museum of American Finance has thousands of examples of Scripophily from the 18th century to contemporary corporations including the Internet bubble. The collection features certificates from a variety of industries – from banking and finance to transportation and technology – and many are signed by historically significant figures, including presidents and other political figures, industry titans and renowned corporate leaders. There is also a link to the Museum’s flickr page: Objects and documents in the collection of the Museum of American Finance, NYC.

I can’t even find the amount lost by Sam Bankman Fried. It might be $8 billion—it might be more. "Sam Bankman-Fried's $16 Billion Fortune Is Eviscerated in Days," Bloomberg News. November 8, 2022; Ge Huange, Vicky; Osipovich, Alexander; Kowsmann, Patricia (November 10, 2022). "FTX Tapped Into Customer Accounts to Fund Risky Bets, Setting Up Its Downfall". The Wall Street Journal;

What Is FTX Token? FTT Explained in Plain English. Shukla, Sidhartha; Ghosh, Suvashree (November 14, 2022). "Crypto.com's Sinking Token Stirs Fresh Anxiety After FTX Wipeout". Bloomberg. Retrieved November 14, 2022.

Scripophily. You never fail to amaze.

One of your best. Does a lot in a short space.

TONO-BUNGAY sounds great. https://en.wikipedia.org/wiki/Tono-Bungay It seems to have elements that were science fiction at the time but have since become routine: "George tries to rescue his uncle's failing finances by stealing quantities of a radioactive compound called 'quap' from an island off the coast of West Africa, but the expedition is unsuccessful." I am ashamed I have not read a lot of Wells outside of his most famous novels and several widely anthologized short stories; he was very prolific. (I love "The Truth About Pyecraft," which I first encountered in one of Alfred Hitchcock's anthologies for young readers: https://the.hitchcock.zone/wiki/Alfred_Hitchcock%27s_Ghostly_Gallery_(book) )

In the abstract crypto and FTX seem like an invention of Victorian futurists like Wells and Verne -- invisible, intangible private currency stored in "adding machines" outside the reach of government treasuries -- but Victorians might have rejected the idea as too absurd.